As trade tensions continue to escalate between the United States and China, the lighting industry can’t help but be impacted. Most of the big brand lighting manufacturers headquartered in the United States manufacture vast swaths of their lighting products offshore. So it’s no surprise the domestically-imposed tariffs on lighting imports are sending shudders through the lighting industry.

Adding fuel to the fire, China is considering constraining their export of rare-earth elements to the United States. China produced 96.9% of all rare-earths mined between 2008 and 2013, according to Congressional Research Service. With their market clout, China has every reason to use rare-earth elements as another tool in their trade toolbox.

How Tariffs Impact Lighting

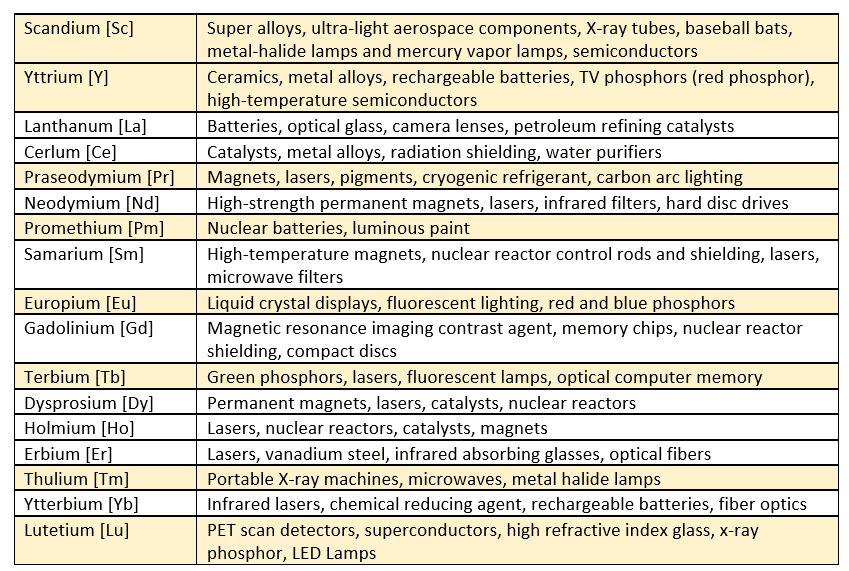

Rare-earths are a huge component in lighting systems – from the semiconductors that fuel our LED engines to the phosphors that convert narrow bands of light emissions into pleasing white light. There are 17 rare earth elements (15 lanthanides and scandium and yttrium). I’ve highlighted the rare earths that are used in lighting.

This sounds familiar…

We’ve read this chapter before. In 2011, China dramatically scaled down on mining and thus exporting rare-earth elements. The Chinese government claimed that the reduction in mining was necessary to address the pollution associated with resource extraction. In turn, they limited how much they’d export to ensure their manufacturers would have enough material for Chinese domestic consumers. During this time, the global costs of rare-earths went up between 800% and 4,000%. This increase led to a bunch of WTO hearings and complaints that, to my knowledge, never went anywhere.

How Does the Efficiency Industry Respond?

Last time a similar increase happened; the lighting industry absorbed the costs for between 6 to 12 months before they had to pass on the costs to consumers. Linear fluorescent lamps (the technology of the day in 2011) went up three-fold for a time. During this time the uncertainty meant that prices fluctuated between project identification and purchasing.

Project developers should keep their eye on trade discussions and make sure they include adequate contingencies in their project costs. Customers looking to implement projects should attempt to accelerate their plans if feasible, to avoid needlessly escalated product costs. And of course, it’s incumbent on us all to participate in the democratic process to make sure sound trade policy and market stability rules in 2020. If you need any assistance planning your next lighting project contact us any time.